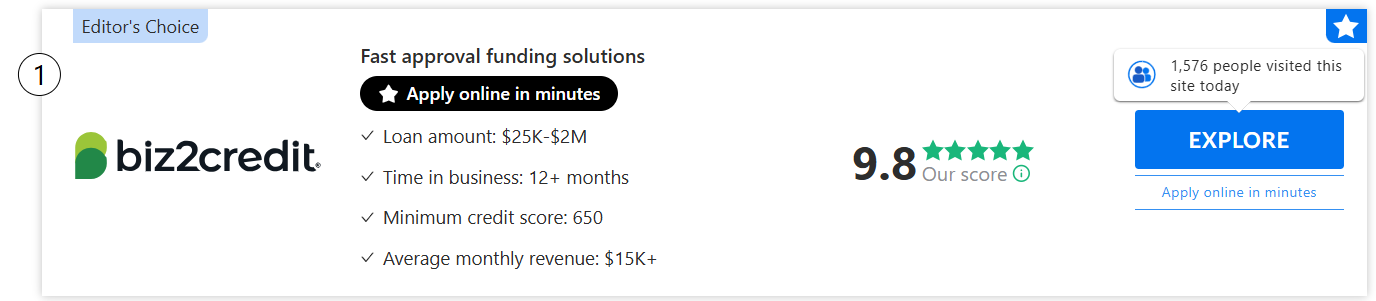

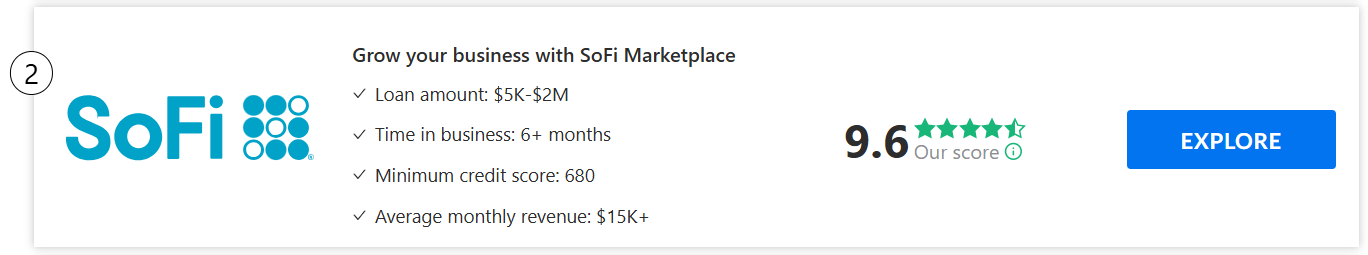

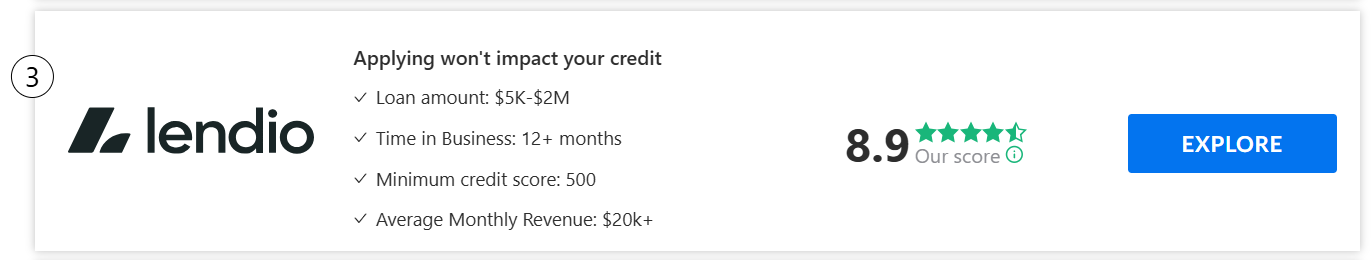

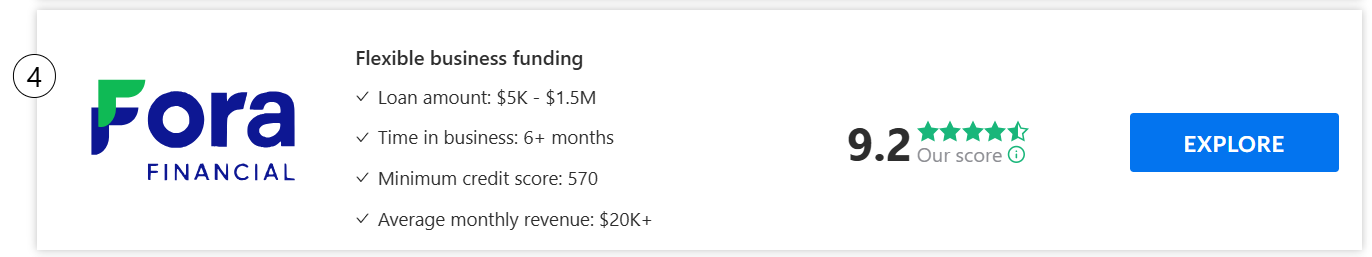

We receive advertising fees from the companies listed in the chart below, which affect rankings

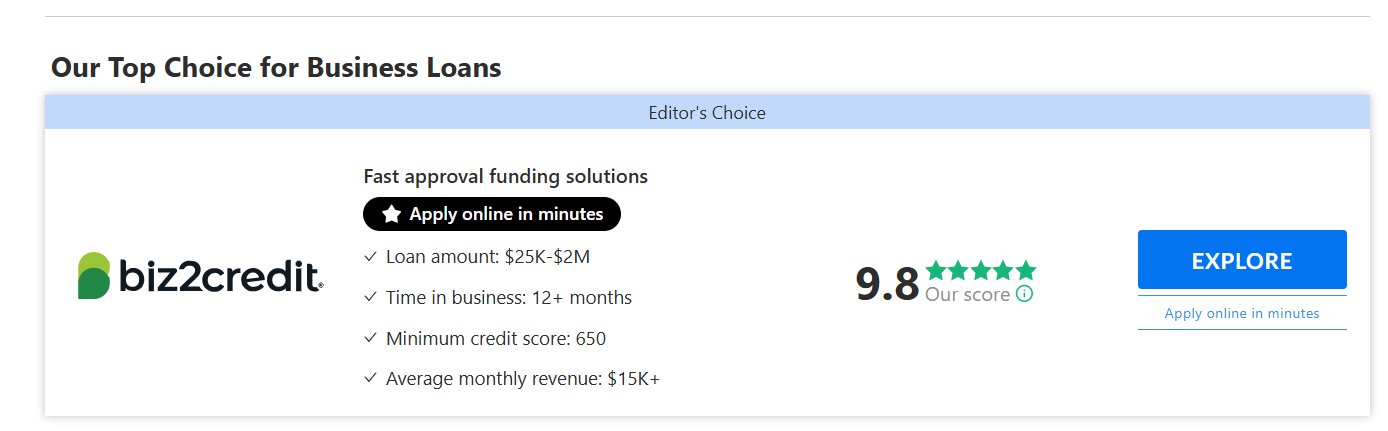

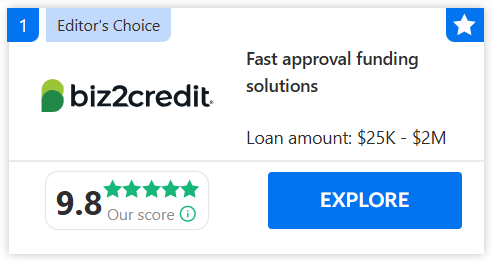

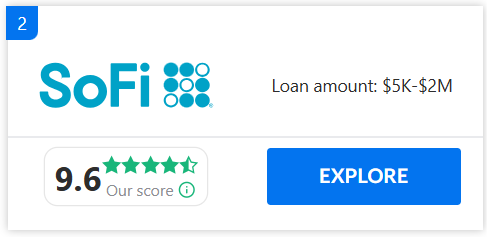

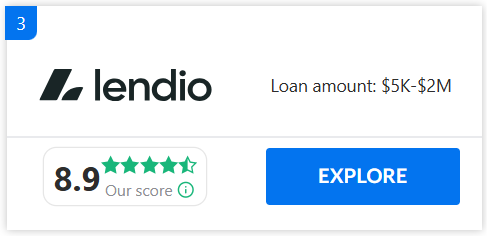

Best Business Loan Lenders in United States 2025

We gathered and compared the best lenders out there. All you got to do is choose according to your specific needs and get a small business loan to push your business forward

- Last Updated: November 2025

Best Business Loan Lenders in United States 2025

Get the funding you need to enhance and grow your business

- Last Updated: November 2025

Business Loans: A Complete Guide for Small and Growing Companies

Business loans are funds borrowed by a company to meet financial needs. These needs may include covering daily expenses, managing payroll, expanding operations, or buying new equipment.

A loan provides businesses with capital they can repay over time with interest. It allows a business to move forward without waiting for savings to grow.

Banks, credit unions, and online lenders all provide business loans. The loan amount, interest rate, and repayment terms depend on the lender’s requirements and the borrower’s credit history.

For many small companies, loans are not just an option but a lifeline. They help businesses handle both planned investments and unexpected expenses.

How Do Business Loans Work?

Business loans are simple in structure. A lender provides money upfront, and the business agrees to repay it in installments with interest.

The process involves three main steps: application, approval, and repayment.

During application, lenders ask for details about the company’s financial history, revenue, and future goals. A clear business plan often increases approval chances.

During approval, lenders evaluate risk by looking at:

- Credit score of the owner and the business

- Annual revenue and profit margins

- Years in operation

- Debt-to-income ratio

- Collateral available for secured loans

During repayment, the business pays back the loan through scheduled payments, usually monthly. Some short-term loans may require weekly or even daily payments.

Interest rates depend on creditworthiness and loan type. Well-established businesses often qualify for lower rates, while startups may face higher costs.

Types of Business Loans Available

Businesses have different financial needs, so lenders offer a wide range of loan types.

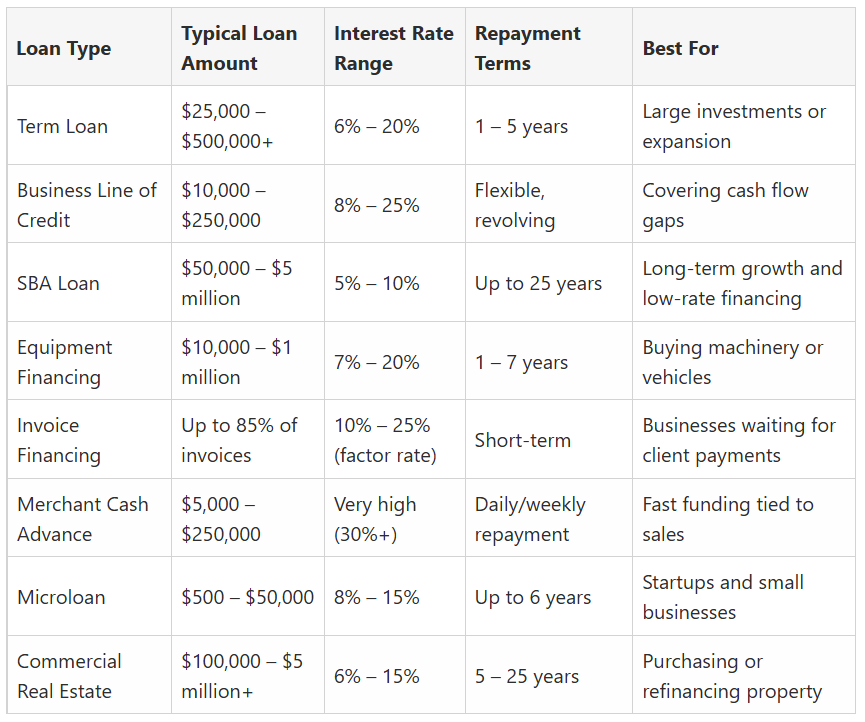

Term Loans

These are lump-sum loans repaid over a fixed period with interest. They’re best for big expenses like office renovations, buying property, or opening a new location.

Business Lines of Credit

Works like a credit card for businesses. You only pay interest on the amount you use. This option is flexible for handling cash flow gaps.

SBA Loans

Backed by the U.S. Small Business Administration, these loans come with low rates and long repayment terms. However, they require strong credit and detailed applications.

Equipment Financing

Helps businesses buy machinery, vehicles, or other equipment. The equipment itself usually serves as collateral, making approval easier.

Invoice Financing

Provides funds based on unpaid invoices. Great for companies waiting on client payments but needing cash quickly.

Merchant Cash Advances

A lender gives a lump sum in return for a percentage of future sales. This option provides fast funding but is usually expensive.

Microloans

Smaller loans, often under $50,000, aimed at startups or businesses with limited credit history. Many nonprofit lenders provide them.

Commercial Real Estate Loans

Used for purchasing or refinancing business properties. Terms are often long, similar to mortgages.

Pros and Cons of Business Loans

Business loans can strengthen a company, but they also carry risks.

Pros

- Access to capital helps businesses expand or handle emergencies quickly.

- Can build business credit when payments are made on time.

- Loan types available for specific needs, like equipment or property.

- Lower rates than using personal credit cards or payday loans.

- Larger funding amounts compared to most personal financing options.

Cons

- Approval requires strong financial history and credit. Startups often face challenges.

- Interest and fees increase total repayment cost.

- Collateral may be needed, putting business or personal assets at risk.

- Late payments can damage credit scores and limit future borrowing.

- Some loans take weeks to process, delaying access to funds.

How to Get a Business Loan?

Preparation is key when applying for a loan. Lenders want to see responsibility and stability.

Steps to follow:

- Check credit scores: Both personal and business credit should be reviewed.

- Organize financial documents: Tax returns, bank statements, and cash flow records are essential.

- Create a business plan: Lenders need to see how the loan will be used.

- Determine loan amount: Borrow only what you need to avoid heavy debt.

- Compare lenders: Review banks, credit unions, and online lenders for rates and terms.

- Submit the application: Be ready to answer follow-up questions.

Applying for a Business Loan

The application process may vary but usually includes:

- Completing forms: Applications can be done online or in person.

- Submitting financial documents: These include revenue statements, tax returns, and debt records.

- Providing loan purpose: Lenders want a clear explanation of how funds will be used.

- Underwriting review: The lender checks credit and financial health.

- Approval or denial: This can take anywhere from a few hours to several weeks.

Many online lenders offer quick decisions, while traditional banks may take longer but provide more favorable terms.

How to Choose the Best Business Loan?

With many loan types available, choosing the right one requires careful thought.

Key points to consider:

- Loan purpose: Match the loan to your specific need, like working capital or property.

- Repayment terms: Short terms cost more monthly but save on interest.

- Rates and fees: Compare annual percentage rates (APR) and check for hidden fees.

- Lender reliability: Work with lenders that have strong reputations.

- Flexibility: Some lenders allow early repayment without penalties.

Quick Tips

- Borrow only what you need.

- Compare at least three loan offers.

- Read agreements carefully before signing.

Final Thoughts

Business loans are a valuable tool for companies looking to grow, manage expenses, or stabilize cash flow. They provide funding for opportunities and protection during tough times.

Understanding how loans work, knowing the options available, and preparing a solid application improves the chance of approval. While loans come with risks, choosing the right lender and loan type can help businesses move forward without unnecessary strain.

By comparing lenders and reading terms carefully, business owners can find a loan that supports growth while keeping costs manageable.

thetopbusinesslenders.com is a free online platform designed to help users with the process of choosing the services or products that meets their needs by providing helpful reviews, articles and comparison based content. We receive compensation from the various brands we review, compare and rank on the website. thetopbusinesslenders.com is not a lender, broker or financial institute, nor a party to any engagement related to financial products or transaction. All rates, fees and offers’ terms presented herein are provided by the third party brands we engage with, which may include lenders, brokers and aggregators. We do not make any decision regarding such rates, fees, terms and eligibility or approval of a financial offer. The actual offer you will receive is subject to its provider’s sole discretion including credit score, minimum deposit, minimum balance, requested loan amount, loan term, etc. and there is no guarantee you will qualify for the rates, fees, or terms presented herein. The content herein is not, and shall not be taken as an endorsement, recommendation or solicitation to borrow or obtain any financial service. We encourage you to carefully review the actual offer’s terms you receive from the provider, including all associated fees and costs. Filing for bankruptcy shall not exempt from repayment obligations.

Annual Percentage Rate (“APR”) is the yearly cost of borrowing from a financial institution, represented as a percentage. The APR includes fees related to originating the loan, not just the interest payments (such late fees, closing fees and administrative fees). Repayment examples (for illustrative purposes only): a $20,000 loan at 6.00% APR with a term of 5 years would result in 60 monthly payments of $387 (Total repayable: $23,199) and a $100,000 loan at 3.00% APR with a term of 4 years would result in 48 monthly payments of $2,213 (Total repayable: $106,245).